How Are Schools Funded?

School Funding Basics:

There are 3 ways a school is funded:

Federal funds account for 11.86% of school districts' General Fund revenue and are appropriated for specific purposes.

State funds account for 63.99% of school districts' General Fund revenue and earmarks revenue from income taxes for public and higher education.

Local funding accounts for 24.15% of the school districts' General Fund revenues.

Local funding consists of revenue from six different taxes that a local school board may levy plus interest on investments, tuition payments, and student fees. Each district must impose a minimum basic property tax levy and contribute the proceeds of that levy to the cost of providing educational services. The more Basic Levy revenue collected, the less state funding-from the Uniform School Fund is required.

Property taxes are the main source of local funding. A local School Board can raise property taxes but has a tax limit levy. These property tax base differences have important ramifications for property tax rates and revenues among school districts. The state will then back fill the shortfall.

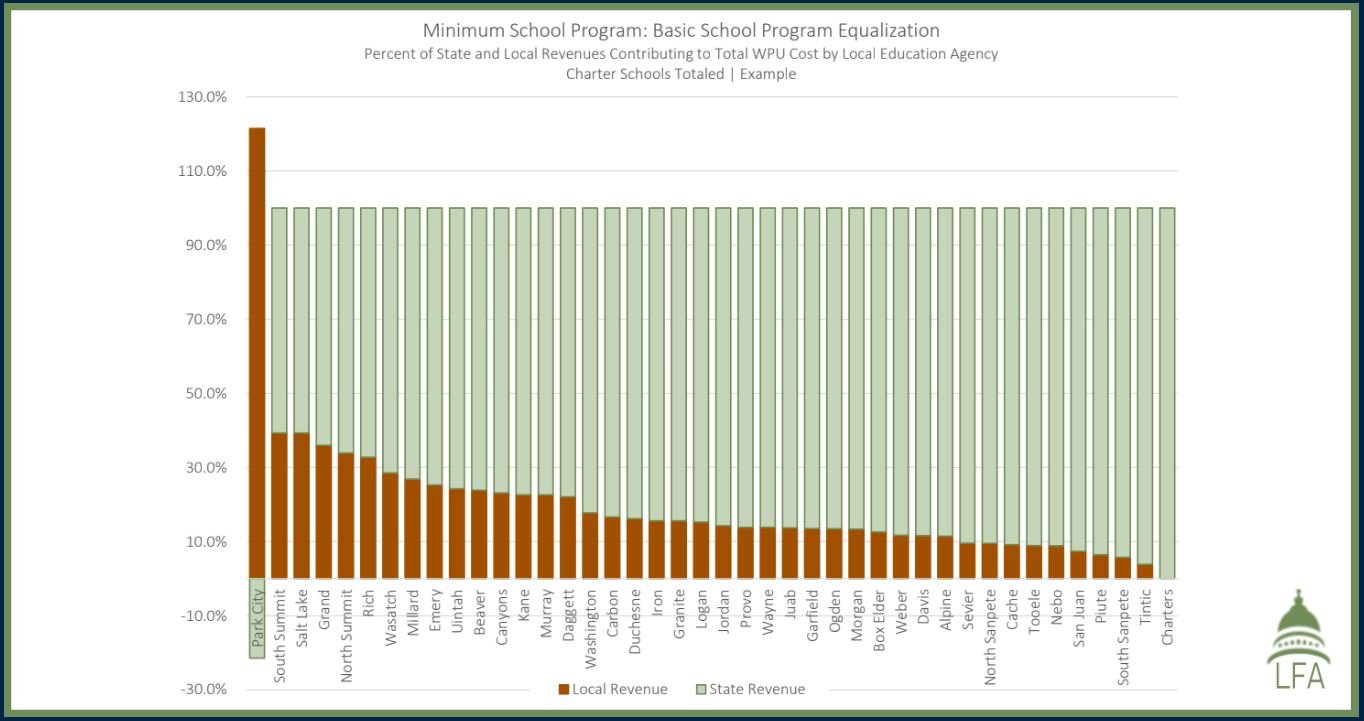

Utah has an equalization funding formula where the state makes up the difference for the shortfall of local property taxes. And when a split occurs the state legislature would not allow the local residents to pay the increased cost - it would cover the shortfall from state funding or from other surrounding districts.

Park city is the only one that can finance its school district based on local property taxes. All other districts get back fill by state funding.

For example, if Park City School District and Tooele County School District were both to impose an identical tax rate of 0.000100, Park City School District would generate over twenty times as much revenue per student as Tooele County School District ($273 compared to $13 per student)

Graphic - Online Courtesy Rob Smith - Utah School Finance - 202

When a school district wants to impose another bond, a city can request a Truth and Taxation meeting. For example - Jordan School District has recently held a Truth and Taxation Meeting for its residents.

An Orem School District would be subject to Utah’s equalization funding opportunities and Tax levy laws if any additional funding is needed as to not be a burden on Orem Tax Payers.

Orem School District would also utilize the State’s WPU funding. What is WPU? Utah Minimum School Programs (MSP) are funded through the Weighted Pupil Unit (WPU). The WPU is a unit used to assign funding after the formula for each funding category is applied.

To determine the amount of funding, multiply the number of WPU by the value of the WPU. WPU values are established by the LEAs based on statutory formulas and program criteria established by the Legislature or State Board of Education and may change from year to year. WPU numbers are the same for every K-12 student in the state of Utah, in any Utah School District. For a simplified explanation visit - DEC 2022 Feasibility Study, Pg 230.

Past WPU’s show a steady incline per student. On March 24, 2022 Gov. Cox signed a historic legislative bill which included a 6% increase for the WPU. The 2022-2023 WPU will be $3,908 per student.

So how much would an Orem School District cost?

Using the guidelines above you can see how much Orem would approximately receive for 15,000 students, which would approximately be $174 Million. The costs to run an Orem school district would approximately be $168.8 Million. An Orem School District will have access to all of the same funding opportunities other Districts in the state use.

Orem School District will have sufficient funding for teacher compensation and benefits, including the 401K retention bonus program, for administrators, office staff, and all other employees at each school and district office.

Resource Links:

Utah State Funds Information by USBE

Minimum School Program Budget Review

Property Taxes and School Funding in Utah

Feb 2, 2022 — HB0001

March 24, 2022 - Gov. Cox signs historic funding for education.

Utah’s State Funds through WPU

2021 Utah Education Funding Study

Other Utah Levy Laws:

https://le.utah.gov/xcode/Title10/Chapter6/10-6-S133.html

https://le.utah.gov/xcode/title59/chapter2/C59-2-S902_1800010118000101.pdf

https://le.utah.gov/xcode/Title17B/Chapter1/C17B-1-P10_1800010118000101.pdf

https://le.utah.gov/xcode/Title59/Chapter2/59-2-S924.html

https://propertytax.utah.gov/tax-rates/property-tax-levies.pdf