Inaccurate Data Provided By Alpine School District

On June 1, 2022, Alpine School District (ASD) released a “Draft District Split Analysis” upon request from Orem Citizens. That information provided by ASD is listed below. Previously in 2021, the Alpine Board of Education had requested different split studies be conducted by ASD’s Business Administrator, Rob Smith, to see where, when and how splitting the district would be most suitable. You can find those requested studies online, along with the Draft District Split Analysis information that has been released to the public. To date, the conversation surrounding Orem splitting from ASD has been decades long. A Timeline with citations is provided through the Orem City portal along with other feasibility studies.

In the released analysis dated June 1, 2022, Alpine School District claims that if Orem City was to create its own School District there would be a deficit amount of funds that Orem’s taxpayers would be obligated to remedy by increasing property taxes. As citizens and state regulation organizations reviewed the data provided by Alpine School District, residents began to share this information. As people learned of this information, more people began to research the financial data and large discrepancies of monies were discovered.

Below you will be able to review the discrepancies and come to the same conclusion that the DEC Study, Utah Taxpayers Association, and others have come to, as well.

Let's review the faulty financial data. Governmental entities have budgets and reporting mechanisms in place which are designed to meet the needs of the entity without large surpluses and deficits. Read more here.

Alpine School District’s revenues per audited financial statements are $625M, yet the calculation submitted by Alpine School District for the potential splits shows a total of $634M. This is a discrepancy of $8.9M.

Alpine School District’s Federal revenues were $50M per audited financial statements, however the calculation provided by Alpine School District for the potential split is $53M. This is a discrepancy of $3.2M.

Alpine School District’s expenditures per audited financial statements are $618M, yet the calculation provided by Alpine School District for the potential split is $630M. This is a discrepancy of $11.5M.

Alpine School District’s Data File (Revenue by City Property Taxes) shows City metrics, including students, adjusted taxable value, which provides important information. To understand the calculations we must know some basic information about Orem and Alpine School District:

Orem has 14,934 students of the total 84,147 in ASD, which is 17.75%

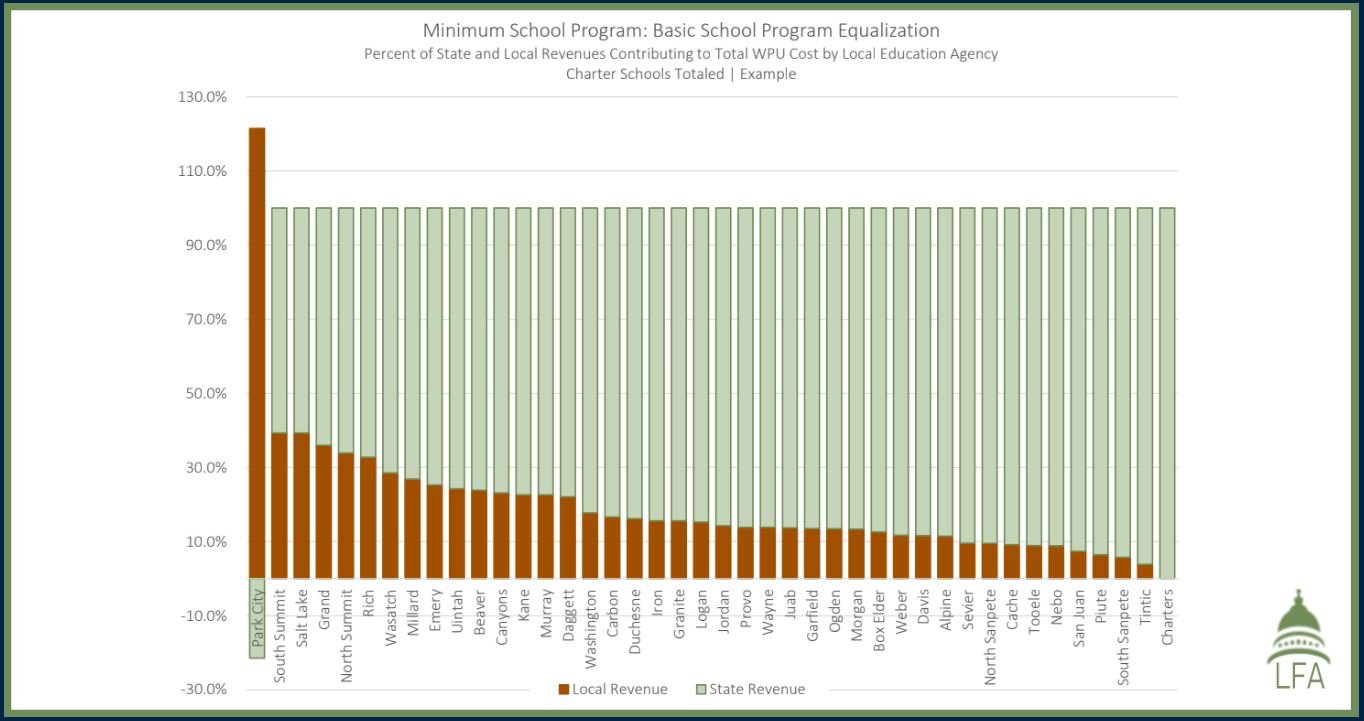

Orem has an adjusted taxable value of $7.286B of the total $33.601B in ASD. In other words, Orem paid $49.1M in property taxes which equates to 21.69% of ASD’s total revenue (see graph below).

Orem provides more money through taxes (21.69%) than students (17.75%). That surplus money is being funneled elsewhere.

Funding for Public Education comes from three general sources: federal, state, and local funds. Property taxes are the main source of local funding which consists of revenue from six different taxes that a local school board may levy, plus interest on investments, tuition payments, and student fees.

On the Utah State Board of Education’s (USBE) website you will find a breakdown of the 6 different taxes used for funding and which categories those tax levies are used for. In this video at minute mark 5:14, Dr. John Barrick explains 5 of these levy taxes. As you learn what the purpose is for the different levy taxes, we come to understand the funding for a school district, and the revenues and expenditures for an Orem School District.

Alpine School District’s property taxes per the audited financial statements were $263M, however the calculation provided by Alpine School District for the potential split is $226M. This is a discrepancy of $37.3M!

On the June 1, 2022 Draft Analysis Summary File that was released to the public, Alpine School District reported the MSP Local & State (WPU value) would be $91 Million (outlined in red). Utah Minimum School Programs (MSP) are funded through the Weighted Pupil Unit (WPU). Learn more about WPU’s. For a simplified explanation visit - DEC 2022 Feasibility Study, Pg 230.

As residents took a closer look at that MSP (WPU) number, it was discovered that Alpine used a different WPU revenue for Orem Students in their report. WPU numbers are the same for every K-12 student in the state of Utah, in any Utah School District.

Alpine School District chose to use the WPU number from 2017, which is significantly lower than the 2021 current number. A difference of misstated revenues between the 2017 and the 2021 WPU number is $412 per student per year. For Orem alone this equates to $6.2M of misstated revenues. WPU Values from 1973-2022 clearly show the yearly values.

Past WPU’s show a steady increase per student per year. On March 24, 2022, Gov. Cox signed a historic legislative bill which included a 6% increase for the WPU. The 2022-2023 WPU will be $3,908 per student and will likely continue to grow yearly, thus helping alleviate the need for a rise of property taxes for Orem residents. In addition, a new quick guide was released in March of 2022 with the FY 2023 year listing the WPU at $4,038 - which is the number that should have been used in Alpine School Districts Summary released on June 1. The FY 2023 WPU revenues from the State of Utah for Orem is $60.3 Million. This money follows the student, regardless of which district they attend and is used primarily for teacher salaries. Learn more about WPU’s.

On Sept 6, 2022Alpine School District released an updated summary analysis file with the WPU’s corrected. This correction changed the Alpine School District’s calculation revenues by $7.6M, in Orem’s favor.

However, as of October 12, 2022, Alpine School District has only adjusted one of the many discrepancies brought to their attention and has re-issued an updated version of the Draft District Split Analysis with just the WPU correction. Alpine School District’s business team has stated there are still mistakes in these numbers, yet has not given a date when the updated calculation will be provided. That $21M you see in the deficit is a cost that should more appropriately be around $13M, according to a member of the Alpine School District business services team. When will ASD provide the updated numbers?

Another discrepancy comes from Fund 10 Expense by Location file where we see the direct and overhead costs allocated to each school in the district and then breaks out Orem’s totals separately.

The Orem expense calculation includes schools that have been removed from Orem:

Geneva Elementary expenses (torn down due to seismic concerns).

Polaris High School, an alternative district-wide high school, is no longer in Orem which ASD expensed entirely to Orem. 113 students at a cost of over $32,000 per student (6x the district average per student expenditure).

Summit High School, another alternative, district-wide school, is no longer in Orem which ASD expensed entirely to Orem. 82 students, at the cost of nealy $31,000 per student (6x the district average per student).

Some of the costs from Geneva Elementary are still valid as those students have been relocated to other schools. However other costs are NOT valid. There is no longer a Principal, VP, Secretaries, Staff, Teachers with pay or benefits at Geneva, nor is there a building to light, heat or cool. We will be conservative with the cost savings estimate: a $6.8M expense which should not be expensed to/included in the Orem calculation.

In Alpine School District’s own slide provided to the Orem City Council in 2017, Alpine School District shows the Debt Fund (Fund 31) is part of ASD’s Annual Revenue & Expenses (see below). This fund is entirely missing from ASD’s calculation, as well as the Capital Fund. These are vital forms of revenue that are necessary in calculating the estimated costs for Orem to establish and run a school district. This is a gross omission on Alpine School District’s part to exclude these two revenue funds from the calculation.

As Dr. John Barrick and 4 other certified CPAs have stated in their recent publication; “ASD’s calculation omitted both the capital and debt funds. Once these additional sources of revenues and expenses are accounted for, we see that Orem provides a subsidy of $9.7 million annually to ASD. A new Orem school board will be able to use these amounts to fix Orem’s seismically unsafe schools and improve education for Orem’s students and teachers. Correcting for these errors and omissions not only erases the claimed deficit but reveals that Orem is contributing a surplus of $9.7 million annually (see chart and details at https://youtu.be/fV4Xc-3lTSQ).”

The Utah Taxpayers Association agrees that these two vital funds must be included in the calculation provided by ASD.

Another discrepancy shown by another Political Issue Committee (PIC), who claims they are using Alpine School District’s calculation itself, uses taxable value calculations from 2020, and that value has changed over 36% since then.

Alpine School District also included the non-K-12 fund into the general fund in their calculation, which is a violation of GASB standards.

If you take Alpine School Districts direct and indirect expenses together from the Fund 10 Expense by Location, they do tie to the audited financial statements, making the publicly released summary file flawed. Below you will see a quick view chart of the reported discrepancies.

Why does ASD have so many significant errors on their summary report? How does this look to Alpine School District Residents? According to Alpine School District Y2 Analytics study, 54% of ASD residents have lost confidence in Alpine School District to manage tax dollars responsibly.

Data provided by Alpine School District in February 2021 shows that an Orem/Vineyard/Lindon split would be the most advantageous of the three splits proposed as shown below. It’s not believable that the data now provided by Alpine School District can be so skewed and disadvantageous a year later. We the people are the shareholders of our Orem Schools and children’s future. We deserve truthful and accurate data.

This data shows that Alpine School District is either incompetent in their accounting calculations provided to Orem for the potential split, or they are purposely withholding vital information in the hopes that the residents of Orem come to the conclusion that the numbers are not in Orem’s benefit to split from Alpine School District so that Alpine School District can hold onto the vital revenues that Orem provides.

“Correcting for these errors and omissions not only erases the claimed deficit but reveals that Orem is contributing a surplus of $9.7 million annually (see chart and details at https://youtu.be/fV4Xc-3lTSQ).” Watch the video.

Property taxes are the main source of local funding. A local School Board can raise property taxes but has a tax limit levy. These property tax base differences have important ramifications for property tax rates and revenues among school districts. The state will then backfill the shortfall.

Utah has an equalization funding formula where the state makes up the difference for the shortfall of local property taxes. And when a split occurs the state legislature would not allow the local residents to pay the increased cost - it would cover the shortfall from state funding or from other surrounding districts. Learn more about school district funding.

Resource Links

Utah Public Finance Transparency

Utah County Clerk/Auditor Transparency

Orem City School District Funding - Part 1 - By Dr. John Barrick

Orem City School District Funding - Part 2 - By Dr. John Barrick

Orem City School District Funding - Part 3 - By Dr. John Barrick

Orem City School District Funding - Part 4 - By Dr. John Barrick

Daily Herald, Oct 22, 2022 - Guest opinion: Orem Voters need Accurate Numbers…

ASD 2021-2022 Report to Utah Gov.

March 2022 WPU Quick Guide

Alpine School District - 2022 RDA Report (see how much Orem has contributed to ASD)

ASD July 1 2020 - June 30, 2021 Comprehensive Annual Budget Report

ASD July 1 2021 - June 30, 2022 Comprehensive Annual Budget Report

ASD July 1 2022 - June 30, 2023 Comprehensive Annual Budget Report

ASD Y2 Analytics Study - Public Notice

ASD Y2 Analytics Study - Youtube, Minute Mark 17.00

ASD Reports/Files - incase they have been removed, go here Location B.